Designed for Financial Institutions

Tokenize with control. connect across borders.

Securely issue, manage, and distribute real-world assets in over 180 countries with Stellar — the blockchain trusted by industry leaders like Franklin Templeton and Wisdom Tree.

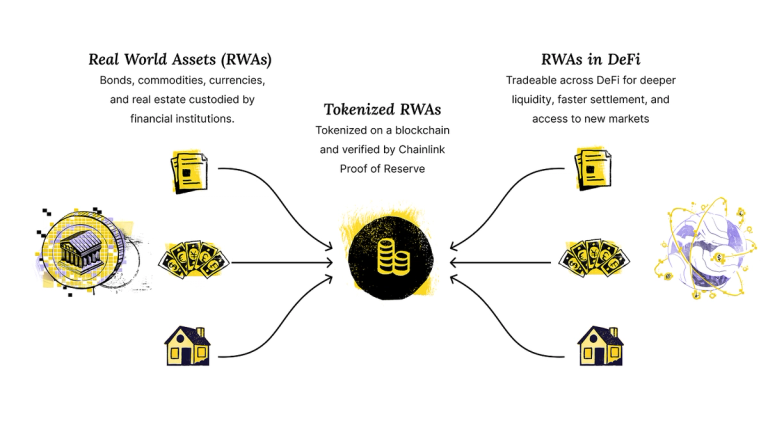

How does asset tokenization work on Stellar?

Stellar empowers financial institutions to move value anywhere, instantly and securely.

Why choose Stellar?

Built-In Asset Controls

Issue and manage assets with ease — no smart contracts required. Native asset controls like allow/deny listing and clawbacks simplify operations and help meet compliance needs.

Advanced Programmability

When your use case requires more flexibility, leverage smart contracts to create programmable assets with custom logic for compliance, yield, governance, and more.

Global Distribution Channels

Make your asset globally accessible by connecting to an extensive network of on and off-ramps across 180+ countries.

Enterprise-Grade Performance

With 99.99% uptime and a network of known, trusted validators, Stellar provides the reliability and security enterprises need.

End-to-End Support

Accelerate your time to market with service providers ready to support custody, analytics, integration, and issuance needs.

Fast Settlement, Low Fees

Transactions on Stellar are confirmed instantaneously and cost a fraction of a penny, making it the ideal platform for tokenized assets at-scale.

Organizations on Stellar

Trusted by global leaders in financial services

Don't Take Our Word For It

Hear from our partners

..for us to do 50,000 transactions on a traditional rail, it cost us $50K. 50,000 transactions on the Stellar network cost us $120.

– Andrew Crawford, Vice President of Digital Assets of Franklin Templeton

Stellar helps people access assets and financial services they wouldn’t otherwise have access to.

– Luther Maday, Head of FinTech & Innovation of MoneyGram International

The Stellar approach and established connections with asset managers and TradFi institutions align perfectly with our mission to achieve broader adoption of stablecoins within the financial system.

– Guillaume Chatain, Chief Revenue Officer of SG-FORGE

Discovery Consultations

Get started

Connect with the Stellar Development Foundation to get personalized recommendations about how to streamline your asset management with tokenization.