Case Study

Blend & Meru case study

Blend is changing the game when it comes to DeFi on Stellar, opening the door for underserved communities to have access to financial opportunities not often available to them through traditional banking services.

Use cases

Where DeFi Meets the Real WorldDeFi

About

What is Blend?

Blend is a DeFi protocol primitive built on the Stellar blockchain that provides the foundation for users to create efficient lending pools and integrate them into their applications for a variety of use cases. These lending pools allow end-users to either deposit assets into the pool to earn interest or use collateral to borrow assets from the pool. In addition, pool creators have significant control over their lending pools with the flexibility to customize key aspects such as supported assets, collateral requirements, oracle selection, and more.

When an application, such as a crypto wallet, incorporates a DeFi primitive like Blend into its functionality, it allows users not only to store and manage their digital assets but also the opportunity to earn passive returns. This added capability enhances the user experience and offers more value beyond traditional wallet services. By providing these opportunities for users, applications can attract a broader audience, increase user engagement, and foster long-term loyalty within the blockchain ecosystem.

How Blend works

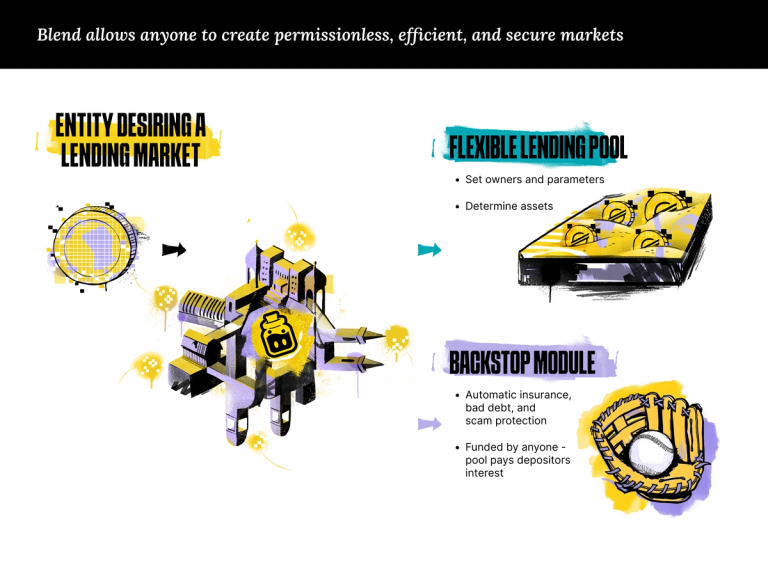

Isolated lending pools

Determine what assets are supported, supply parameters, if it’s a standard or owned pool, which oracle is used for pricing, and more.

Backstop module

A pool of funds that serves as first-loss capital, meaning it absorbs initial losses to reduce risk for investors and attracts additional funding for each isolated lending pool.

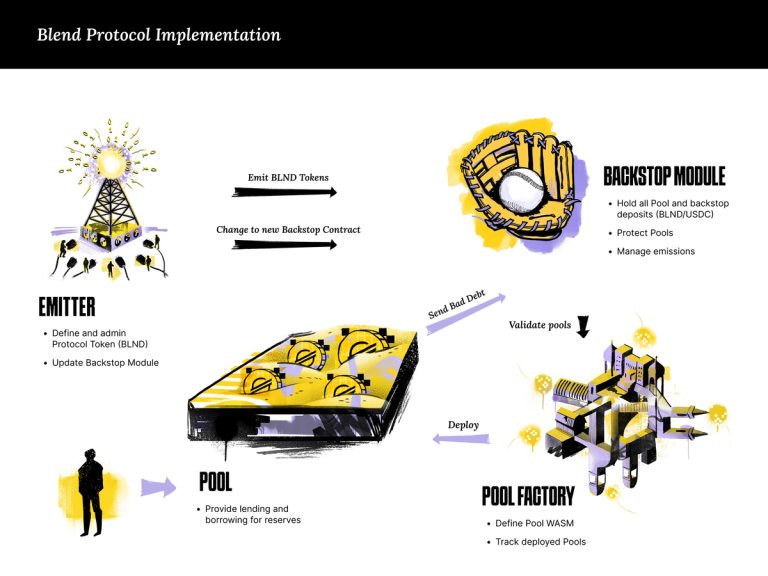

Blnd tokens

Blend’s protocol token; its primary purpose is to manage lending markets through the backstop module. Users who deposit into and withdraw from lending pools and/or who deposit into the backstop module are eligible to receive BLND tokens for participation.

Utilization caps

Pool creators can set these on collateral assets to protect lenders from oracle instability or collateral asset exploits that limit borrowing to ensure lender safety.

Price oracles

Fetches prices for assets in the lending pool and are used to determine whether a borrower’s liabilities are sufficiently collateralized. The lending pool creator specifies the price oracle to use upon lending pool creation.

Lending Pools

Isolated lending pools and backstop

What's a Lending Pool

A lending pool is an automated smart contract that governs the operations of the pool. It manages the interest rates, collateralization ratios, interest payment distribution, and the lending and borrowing between users for a set of supported assets. Blend is permissionless, meaning anyone can use a lending pool directly, implement a lending pool into their application, or deploy a lending pool and set the parameters that govern it.

How does it work?

Blend employs isolated lending pools, meaning a user’s financial position and involvement in one pool is completely independent of all other pools. This ensures that the collateral and debt associated with one pool do not impact others — issues such as unpaid loans (bad debt), liquidations, or inaccurate pricing data (bad oracles) in one pool cannot affect users in another. As a result, users setting up a new lending pool don’t have to worry about unexpected risks from various other pools.

Permissionless, efficient & secure

Safety Net

Backstop module

Another key component of Blend is the backstop module. Each isolated lending pool has its own backstop fund, managed by the backstop module, that acts as an emergency fund for that lending pool. If an issue arises, such as a borrower defaulting on their loan and the liquidation auction for the collateral not fully covering the debt, the backstop module fund is the first resource to help mitigate the loss. The backstop module provides an additional layer of protection for lenders and borrowers by helping to cover shortfalls in each pool, although it does not guarantee full recovery in every case.

The backstop module is an 80/20 weighted BLND:USDC AMM pool funded by users who contribute capital. Anyone can deposit into the backstop module and, in return, receive a take rate, which is a portion of the interest paid by pool borrowers. The take rate percentage is set when the pool is created and can help users decide whether to allocate funds to the lending pool, the backstop module, or both, based on the interest and take rates.

Users can withdraw their backstop module deposits at any time, but the withdrawal process involves a 21-day waiting period called a withdrawal queue. After the 21 days, users are able to withdraw their funds, provided there is no remaining bad debt in the backstop module. This withdrawal queue helps ensure the backstop module can serve its role as an additional safety net for the lending pool.

Now that we’ve got some Blend basics down, let’s talk about a wallet that already has Blend integrated into its functionality.

Blend protocol implementation

The Wallet

Blend + Meru

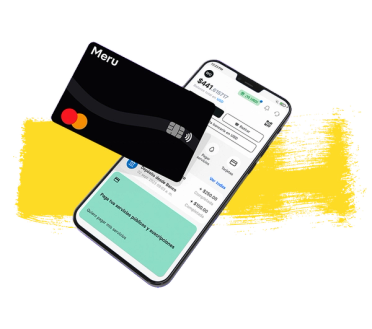

Meru is a Stellar Community Fund (SCF)-funded, non-custodial USDC digital wallet launched in August 2022 that allows small-medium enterprises (SMEs), freelancers, and remote workers from Latin America to engage in cross-border trade. Meru is specifically tailored to help smaller businesses pay individual workers while avoiding typical cross-border payment issues such as high fees and long settlement times. It also allows freelancers and remote workers to get paid, save, spend, and potentially earn yield.

DeFi

The future of financial inclusion

DeFi primitives such as Blend have the power to open up financial opportunities to individuals who may not otherwise have them, and wallets such as Meru are already doing just that. With the Blend and Meru collaboration, freelancers and individuals in Latin America are not only able to get paid easily for their work, but they also have the opportunity to earn yield on their assets. With Blend’s over-collateralized lending model, backstop module, and isolated lending pools, users are more protected against potential negative scenarios such as bad debt or bad oracles.

Tools like Blend are game-changers, especially in emerging markets. Learn how to implement Blend into your own application by heading over to the Blend GitHub or by viewing Blend’s documentation and keep your eyes open for more Stellar-based applications using Blend in innovative ways that ultimately contribute to creating a more financially inclusive future.

Disclaimer: The projects listed above are independent third parties building on the decentralized and permissionless Stellar network. These are examples of potential utility when building on the Stellar network and are referenced for those general informational and educational purposes only. This content does not constitute a recommendation, promotion of, or solicitation to, transact in any digital assets and should not be construed as financial, legal, or investment advice. SDF does not control or endorse any third-party services referenced above and is not liable to you for third-party services in any way. If you choose to use any third-party projects listed on this page, you acknowledge that you do so independently, at your own risk, and you should ensure you are aware of any security, financial, legal, and tax implications applicable to you. Any statistics mentioned above relating to returns are based on historical data, are for information purposes only and are not an indication of future results. Always consult with independent financial professionals before making financial decisions.